en

en

-

es

es

-

en

en

en

en

-

es

es

-

en

en

UGPP penalties for self-employed workers and capital rentiers

If you are self-employed or capital rentier, there is a possibility that you have received by e-mail a persuasive communication from the Special Administrative Unit of Pension Management and Parafiscal Contributions of the Social Protection (UGPP), where you are requested to make your affiliation to the social security systems in order to comply with the payments corresponding to the social security contributions as established by law.

However, this does not exempt that the UGPP proceeds to audit the contributions that gave rise in previous years, now, if you have not received such communication and perhaps you have not stipulated the current correspondence address in your RUT it is likely that you will not be notified personally, therefore you have high probability of risk in incurring in the sanctions provided by the entity, for such reason we allow us to give to know taxatively what exposes the article 314 of the law 1819 of 2016, with respect to the sanctions of the UGPP to the independent according to the tax reform.

Article 314 of Law 1819 of 2016, provided the sanctions to be applied by the Pension Management and Parafiscal Contributions Unit - UGPP, where it provides:

The methodology to establish the calculation of the penalty for omission at (5% for each month or fraction of month) of the value left to liquidate and pay in response to the Requirement to Declare and/or Correct and not under the criterion of number of employees and the increase to 10% in the Official Liquidation, well, it establishes a limit to the amount of the penalty, It establishes a limit to the amount of the penalty, 100% with the requirement to Declare and/or Correct or 200% with the Official Settlement, eliminating the percentage of 20% and maintaining the percentages of the penalties of 35% and 60% that are currently in the regulation, these penalties are unified for both dependent and independent contributors.

The benefit of exoneration of the penalty is extended until before the issuance of the requirement to declare and/or correct voluntarily to the correction of the self-assessments; the benefit of exoneration is also extended when the contributor corrects the requirement to declare and/or correct until the date of notification.

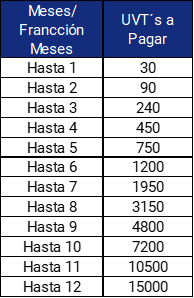

A maximum penalty of 15,000 UVT's is imposed as shown in the table of incremental and differential penalty for each month or fraction of month of non-compliance.

"The maximum sanction to be applied to entities that carry out collective affiliations without being authorized by the Ministry of Health is the maximum sanction for not sending information: 15,000 UVT".

Once the term for submitting the information has expired, there is the possibility of reducing the penalty, provided that it is delivered within the limit of the following (12) months that stimulates the delivery of the information as follows:

Our recommendation regarding this type of requirements:

- Contact the UGPP and verify if there are any auditing processes in your name.

- Respond clearly, precisely and concretely to the requirement within the peremptory terms.

- Avoid presumptions and assumptions by the UGPP in the liquidation of your contributions.

- Get advice from our legal team with experience in the subject.

- Do not omit the information provided by the UGPP, since the omission will not be an impediment for the auditing processes by this entity.

-

Verify your contact information registered in the RUT (Notification Address), update it if necessary.