en

en

-

es

es

-

en

en

en

en

-

es

es

-

en

en

UGPP Lawyers

Lara & Lopez Abogados y Consultores S.A.S., is an auditing firm that offers UGPP representation and advice to individuals and / or legal entities, the representation by our lawyers specializing in UGPP is in all types of requirements. We are UGPP advisors pioneers in achieving a benefit for you as an independent, capital rentier or company with an integral and complete UGPP consultancy in all the stages of the UGPP administrative procedure. Likewise, through UGPP consulting, payroll audits with UGPP approach, we validate the inaccuracies that arise, in order to reduce values within the administrative process carried out by the UGPP.

Thanks to our multidisciplinary team we offer the best UGPP advice, through the service of preventive corporate audits UGPP, we perform the respective validations to determine the proper, correct and timely payment of parafiscal contributions, in accordance with current regulations, mitigating onerous fines and penalties imposed by the UGPP, in the same way minimizing risks and avoiding impacts on their assets.

Our UGPP Attorneys, handle a specific line for the role to play in advice and representation UGPP that will allow your case to be analyzed in a thorough and detailed manner, necessary for a quality and timely response to the UGPP. We have specialized UGPP lawyers, who based on their experience will take any case to the best possible success rate.

Among the services and activities we offer are:

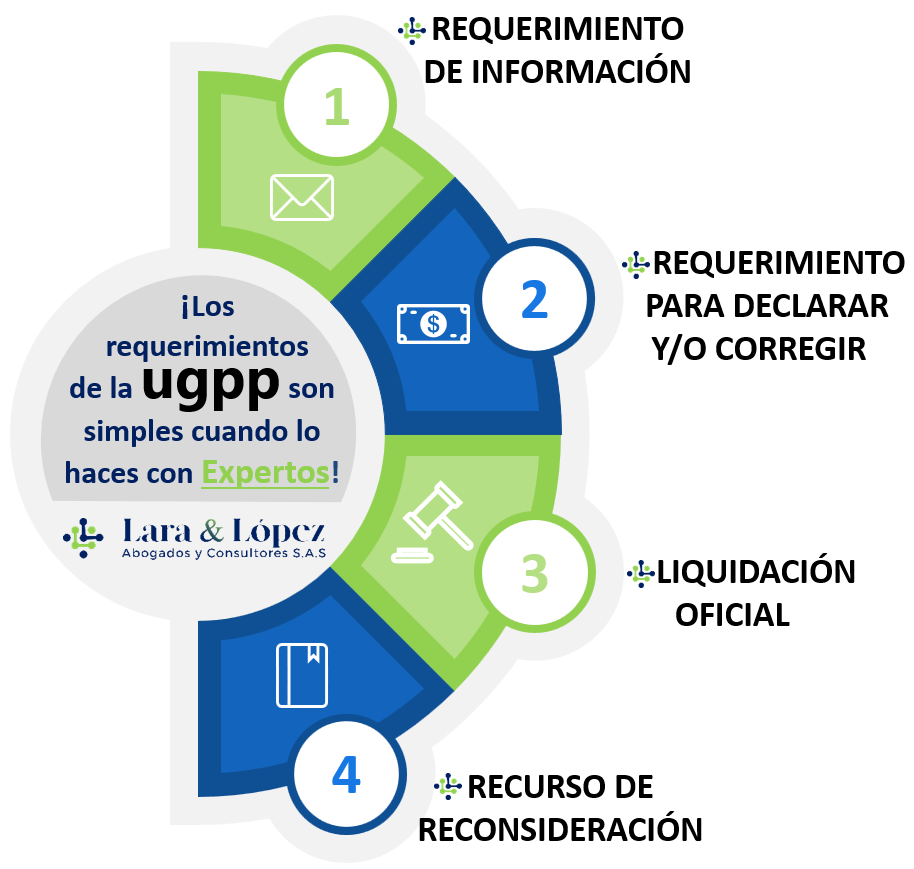

Information Requirement

-

In this administrative auditing event initiated by the UGPP, we advise legal and/or natural persons who are being audited by the UGPP, where we provide the service of preparation of the payroll instructions, according to the Payroll Template InstructionsPayroll template instructions presenting it in accordance with the guidelines established by Resolution No. 0922 of 2018.

- With professionalism, our team of UGPP experts will audit your payroll instructions and reconcile the accounting auxiliaries vs. the trial balance, giving the guidelines from the labor, tax, accounting, financial and documentary areas for the UGPP, in order to avoid the collection of penalties and fines for delivery of incorrect information, issued by the Special Administrative Unit for Pension Management and Parafiscal Contributions of the Social Protection (UGPP).

Requirement to Declare and/or Correct

-

In this administrative act of control of the UGPP, the unit proposes to the contributor the obligations pending payment due to inaccuracy, default and omission, so our UGPP specialists perform the legal and accounting-financial support presenting the objections and reasons for non-conformity to the requirement to declare and / or correct UGPP, as attorneys-in-fact, we audit the information provided by the UGPP in magnetic media, in a precise, concise and detailed manner, record by record, in order to identify, correct and object to the inconsistencies identified by the UGPP.

-

Likewise, our advisors UGPP will argue in writing and act the rights of defense with the relevant evidence and attachments, this in order to make the corrections within the terms set, settling the default interest and penalties that may apply within the framework established in Article 314 of Law 1819 of 2016.

Official Settlement

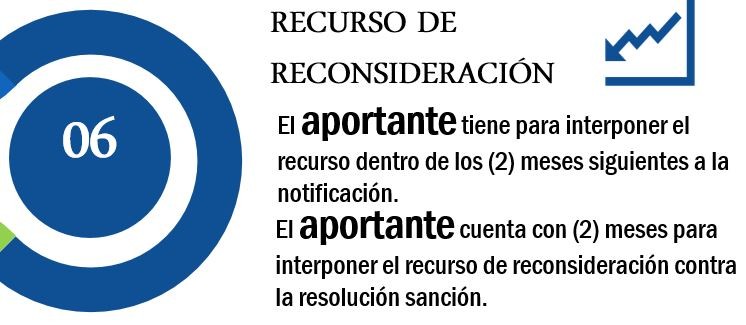

- This final action issued by the UGPP modifies the self-assessment of the contributor and/or determines the obligation to pay, for which we carry out the filing of the reconsideration appeal against the official UGPP settlement or the sanctioning resolution issued by the subdirectorate of determination of obligations, prior to the review and study of the case by our team of UGPP lawyers, in reference to the value of the obligation, the necessary evidence and attachments corresponding to the particularity of the case will be provided, complying with the requirements established in Art. 722 of the tax statute.

Statement of Objections Penalty Resolution

-

In case of notification of the statement of charges, by means of which the respective UGPP sanction is communicated for not sending information, Lara & Lopez Abogados y Consultores S.A.S., will carry out the respective legal accompaniment presenting the objections against the proposed sanction within the three (3) months following the notification of the administrative act of the UGPP, by means of a formulation of discharges against the statement of charges, arguing and supporting the due objections exposed against the proposed sanction.

-

The UGPP must respond within the following six (6) months, where it will issue the respective UGPP Sanction Resolution, against this administrative act the respective Appeal for Reconsideration must be filed within two (2) months following its notification.

Persuasive Process

-

Process in which actions are taken so that debtors voluntarily pay their obligations within 90 calendar days from the first UGPP persuasive action.

Coactive Process

-

At this stage we answer the UGPP payment order, filing the corresponding exceptions, in order to avoid precautionary measures in the direct execution of the obligation based on the administrative procedures of coercive collection of the UGPP. We accompany in the process the taxpayer in the lifting of the same, through payment or payment agreements.

Termination by Mutual Agreement

-

We advise and accompany those who have been notified of a requirement to declare and/or correct, and/or official liquidation and/or UGPP resolution, which decides the appeal for reconsideration and are willing to terminate in advance and by mutual agreement to avail themselves of the tax benefits of Law 2010 of 2019, before it becomes final or expires the term to sue through the means of control, nullity and restoration of rights, this validating the UGPP determination and UGPP sanctioning processes that are ongoing in the UGPP entity.

Why choose us

-

Lara & Lopez Abogados y Consultores S.A.S., our services are personalized and a previous study is made according to your situation, we do not propose generic models for all activities, on the contrary, we take the best alternatives according to the current regulations, in order to offer in each service an integral solution and according to the need of each client.