en

en

-

es

es

-

en

en

en

en

-

es

es

-

en

en

Financial Advisory

Lara & Lopez Abogados y Consultores S.A.S., is an auditing firm that offers a service that allows you to make efficient decisions, thanks to the analysis of financial needs and circumstances in, liquidity, profitability, market, investment, valuation among others. We carry out all the approaches to manage, forecast, evaluate and solve all the financial situations of your company.

We manage to establish all the pertinent objectives and goals for your company to improve its financial situation.

Among the services and activities we offer are

Financial Risk Management

Lara & Lopez Abogados y Consultores S.A.S., is an auditing firm that offers a service that allows you to make efficient decisions, thanks to the analysis of financial needs and circumstances in, liquidity, profitability, market, investment, valuation among others. We carry out all the approaches to manage, forecast, evaluate and solve all the financial situations of your company.

We manage to establish all the pertinent objectives and goals for your company to improve its financial situation.

Among the services and activities we offer are:

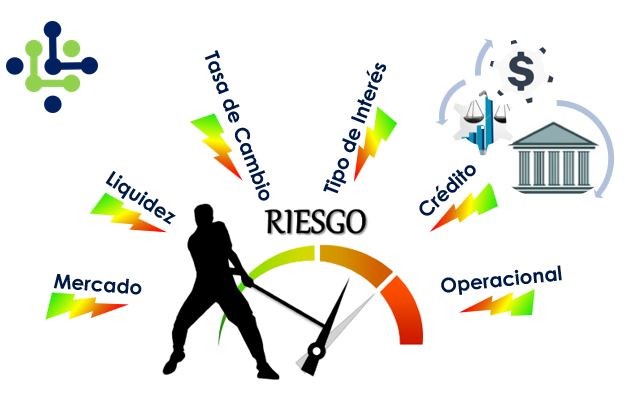

Financial Risk Management

- We offer a detailed analysis to determine the degree of exposure of your company to risk situations that may be inherent to your business activity, thus achieving a comprehensive diagnosis, which generates a coverage to such exposures and thus improve your profitability and competitiveness. We are experts in dealing with risks such as:

- Operational Risk

- Liquidity Risk

- Credit Risk

-

Market Risk

The firm provides solutions that contribute significantly to your company's results.

Financial Projections

- We propose the forecast of the future economic-financial results of your company with respect to its operations, comparing them with the sector and the competition, validating the financial stability that will allow you to demonstrate the business opportunity in the future.

- We perform an analysis of your financial statements with the accounts that show the reality of your company, contributing a solidity for the future from improvement plans at a strategic level in production processes, market, sales, production and others.

Due Diligence

- The auditing firm provides a detailed analysis in all areas of the business, minimizing to the maximum the implicit risk to appreciate hidden liabilities and / or incontinences that allow the development of appropriate strategies for economic benefit.

- We perform a complete investigation of investments, financial transactions, international suppliers; to verify titles, certifications, references, pending litigation, environmental issues, sources of information, payroll records, personnel files that allow us to validate in depth the state of your company.

Capital Structure

- We validate the funding ratio between liabilities and equity to facilitate an assessment of your company's situation, versus long-term debt and equity to finance operations.

- We estimate the variables to identify your funding and debt risk.

Advice on company acquisitions, mergers and spin-offs

- We provide the degrees of control according to the percentage of capital, in order to carry out a partial or total purchase of participation and power to be considered for distribution.

- We manage to generate cost reduction in intentions of integration of companies, obtaining tax incentives, inclusion in the industry and / or a country, reducing the level of competition.

- We provide full support in the process of dividing your company's assets and liabilities in the best possible way, achieving satisfactory and fair results.

Why choose us

- Lara & Lopez Abogados y Consultores S.A.S., is an auditing firm formed by financial experts in their profession, therefore the services are offered thanks to the experience presented in the market. Additionally, the firm has experts in labor, tax, civil, commercial, real estate and criminal law, which make any decision making or changes in your company a management within the competent regulation avoiding errors in the solutions that the firm proposes.

- The firm offers a value for its services related to quality and service.

- The services are personalized and according to your situation, no generic models are proposed for all activities, on the contrary, the best theories, modeling, technological and financial changes of today are taken, to offer in each service a financial solution according to the needs of each company, taking into account that each company is located in a sector, size, regulation and activity different from the others.