en

en

-

es

es

-

en

en

en

en

-

es

es

-

en

en

Contributions to the General Pension System will be 3% for the April and May 2020 periods as a result of COVID-19.

Employers of the public and private sector, dependent and independent workers who are affiliated to the General Pension System, in private funds or average premium regime, will make contributions for the periods of April and May, with a contribution rate of 3% to the General Pension System, which will be made in the months of May and June 2020. Likewise, the contribution made by the employer for private or public sector workers will be 75% and 25% by the worker. Self-employed workers will pay 100% of this contribution (3%).

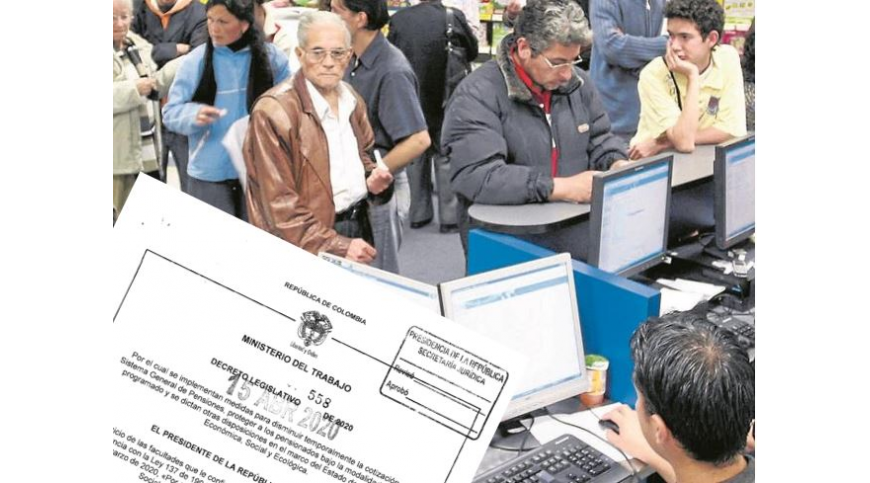

The President of the Republic issued through Legislative Decree 558 of 2020, this measure in order to opt for relief and provide greater liquidity to employers and dependent and independent workers and is effective as of April 15, 2020.

The 3% contribution is taken in order to cover the costs of the provisional insurance in the Individual Savings with Solidarity Regime or the contribution to the disability and survival funds of the Average Premium Regime, as applicable, as well as the value of the administration fee that hinders the current activities as a consequence of the COVID-19 Coronavirus.

The Administrators of the General Pension System must act in favor of their affiliates, that is to say, the weeks corresponding to the two months contributed under the rules of the Decree will be counted to complete the weeks of contribution and access the pension guarantee.