en

en

-

es

es

-

en

en

en

en

-

es

es

-

en

en

Tax Benefits for self-employed - UGPP

INDEPENDENT TAX BENEFITS - UGPP

Founding partner Dr. Edwin Mariano Lara Mora is a corporate lawyer with a double degree in the areas of Labor Law and Social Security from the Universidad del Rosario, expert in administrative proceedings before the UGPP, through this article he expresses the following:

Pursuant to the extension of the tax benefits established in Articles 118 and 119 of Law 2010 of 2019, which were extended until June 30, 2021, in accordance with the provisions of Article 123 of Law 2063 of November 28, 2020, self-employed independent workers, who have as of this date with audit processes in the official stage and discussion of the parafiscal contributions of social protection, as well as in the process of direct revocation of administrative acts issued by the Special Administrative Unit for Pension Management and Parafiscal Contributions (hereinafter UGPP), either ex officio or at the request of a party or offered before the contentious administrative authorities, may continue to benefit from the scheme of presumption of costs for self-employed workers with a contract other than the provision of personal services.

In view of the above, it is necessary to briefly explain what the cost presumption scheme for self-employed workers consists of, as indicated by the UGPP:

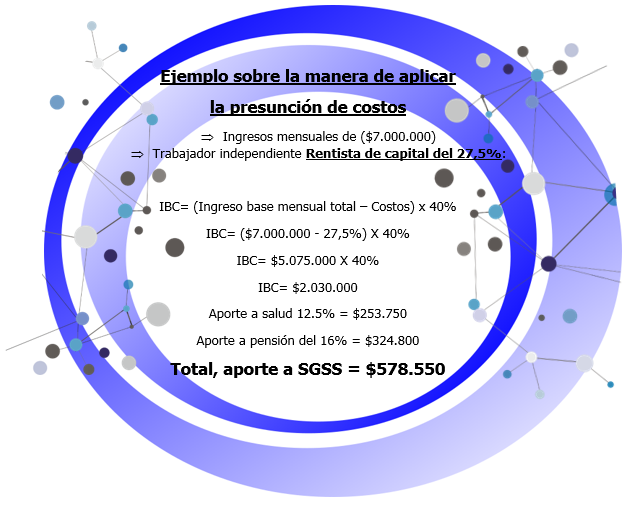

"(...) It is a tool that allows deducting from the total income a fixed percentage associated with the economic activity developed by the independent worker, to determine in an agile and practical way the net income on which he/she must make his/her contributions, facilitating the calculation of the costs incurred by workers in the development of their economic activity without the need to submit supports or documents. (...)"

According to the above definition, the independent worker will be able to deduct from the total income a fixed percentage associated with the economic activity he/she develops, so it would lead us to know which are the percentages established for each activity:

Þ Wholesale trade (75.9%).

Þ Exploitation of Mines (74,0%)

Þ Agricultural and livestock sector (73.9%)

Þ Lodging and food services (71.0%)

Þ Manufacturing (70.0%)

Þ Education (68.3%)

Þ Construction (67.9%)

Þ Transportation and warehousing (66.5%)

Þ Real estate activities (65.7%)

Þ Artistic activities (65.5%)

Þ Other economic activities (64.7%)

Þ Administrative service activities (64.2%)

Þ Other service activities (63.8%)

Þ Information and communication (63.2%)

Þ Professional activities (61.9%)

Þ Human health activities (57.7%)

Þ Financial activities (57.2%)

Þ Capital income earners (27.5%)

The above percentages were established in the following Resolutions issued by the UGPP:

Þ Resolutions 1400 of 2019, for self-employed independent workers whose economic activity is public motor freight transport by road.

Þ Resolution 209 of 2020 established for self-employed independent workers and for those who enter into contracts other than the provision of personal services that involve subcontracting and/or purchase of inputs or expenses.

Who can take advantage of the Tax Benefits of Law 2010 of 2019?

The tax benefits to apply the scheme of presumption of costs for independent workers to be verified by the UGPP, will be the following:

Þ Having net income equal to or greater than one (1) Minimum Legal Monthly Minimum Wage in Force (SMLMV).

Þ The total monthly value for concept of contributions has not been paid, including interests, determined in the last administrative act notified by the UGPP.

Þ They have not demonstrated the costs and deductions associated to their economic activity and their process with the UGPP is in process to issue: i) Official liquidation; ii) Resolve an appeal for reconsideration; iii) Request for direct revocation; iv) Direct revocation ex officio or at the request of a party and; v) Offer of revocation before the contentious-administrative authorities.

It is important to remember that against the resolution issued by the UGPP where the presumption of costs scheme is applied, there is no appeal or refund of contributions.